UPDATED: The governor also killed tax proposals approved by the Legislature for vacation rentals and real estate investment trusts.

By Blaze Lovell Honolulu Civil Beat

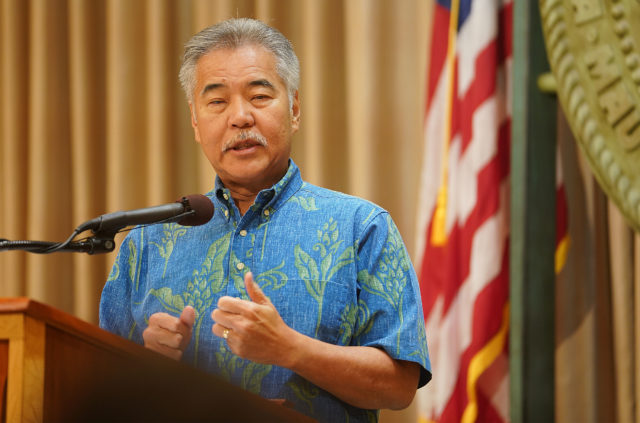

Gov. David Ige followed through with his plan to veto a proposal that would have reformed Hawaii’s often criticized civil asset forfeiture program.

Critics have said that the program is rife with abuses, but Ige said Hawaii’s program already has safeguards against abuse. He said the state Attorney General’s Office reviews each civil forfeiture case, and even rejects some they don’t believe are appropriate.

The measure was one of 18 that Ige vetoed Tuesday.

Ige said in June he would likely veto 20 measures, including two tax proposals on real estate investment trusts and short-term vacation rentals. He vetoed both of those Tuesday

Gov. David Ige made good Tuesday on most of the vetoes he had earlier said he was leaning toward.

Cory Lum/Civil Beat

The Legislature considered convening a special session in an attempt to override some of the vetoes, but lawmakers decided they didn’t have the votes to overturn any of them.

However, Ige took two measures off his veto list. He will allow a proposal to raise the ceiling on tax credits for the film industry as well as another that could grant condo associations more foreclosure power to pass into law without his signature.

‘Very Disappointed’

Ige’s decision to veto House Bill 748, the forfeiture reform bill, was met with swift rebuke from a state lawmaker and advocacy groups.

“I’m very disappointed,” Rep. Joy San Buenaventura, the Puna lawmaker who sponsored HB 748, said. “It’s basically the governor saying business as usual is the norm.”

The bill would have required prosecutors to secure a felony conviction before they sell someone’s property. Lawmakers previously said that the bill was a compromise between reform of the program and the wants of law enforcement.

Rep. Joy San Buenaventura said Ige’s decision to reject reforms in the property seizure program was “basically the governor saying business as usual is the norm.”

Cory Lum/Civil Beat

San Buenaventura, who first introduced a proposal to reform the seizure program in 2016, has been one of the strongest advocates for reform. She said she isn’t sure what measures to address asset forfeiture might look like next legislative session.

She said, though, that she plans to introduce a resolution asking county prosecutors to provide an account of the property they seize.

An audit from last year found that property was seized and sold in 26 percent of civil asset forfeiture cases with no corresponding criminal convictions.

Ige said that not all asset forfeiture cases may involve possible felony charges, and the bill as it was written may not have allowed law enforcement to seize property from potential criminal enterprises.

“One of the purposes of civil asset forfeiture is to stop criminal activity,” Ige said. ‘We felt that the law would be too restrictive.”

HB 748 would’ve allowed law enforcement to still seize property. However, authorities would have needed to wait until there was a felony conviction of the owner before selling the property.

The AG’s office still has not adopted any administrative rules to regulate an asset forfeiture program that has existed since 1988.

Those rules could create a process to recover wrongfully seized property, for example. Ige asked the office to complete the administrative rules by the end of the year.

Ige said that Hawaii doesn’t have the same kinds of abuses of property seizure programs seen in other states and has safeguards to protect against it.

One of the deficiencies of Hawaii’s civil asset forfeiture program is a lack of publicly available data, said Nikos Leverenz, the board president for the Drug Policy Forum of Hawaii.

Hawaii’s asset forfeiture law requires an annual report to the Legislature, which includes total amounts for property seized, types of property seized, types of judicial actions and amount of sales. The report also requires descriptions of what the money is spent on.

Leverenz, who worked for 10 years in California as a public policy consultant, said that reports should also include more accounting on each asset forfeiture case initiated in the state as well as updates on the disposition of those cases.

In California, the AG’s report includes all that along with itemized lists of seized property and their values.

San Buenaventura said that she wants the county prosecutors to give the Legislature a better account of how revenue generated from seized property fits in with their budgets.

“It seems to me they should use those proceeds before they ask us for more money for other things,” she said.

Boosts For Film Industry, Condo Associations

Ige took two measures off his veto list. He will allow a proposal to raise the ceiling on tax credits for the film industry as well as another that could grant condo associations more foreclosure power to pass into law without his signature.

SB 551, the condo measure, will grant condo associations more power by retroactively allowing them to conduct nonjudicial foreclosures without a clause in their bylaws stating they may do so.

That was an issue in a number of court cases already underway in which homeowners filed class action lawsuits against more than 70 associations and the law firms representing them over wrongful foreclosure.

it’s not clear how the law will be applied in those cases.

Critics of the bill have said in testimony to the Legislature that the new law amounts to bailing out those associations.

Ige initially wanted to veto the bill because his administration believed the retroactive parts could be unconstitutional. He said Tuesday that parts of the measure that clarify Hawaii’s foreclosure law are appropriate, though he was still concerned with the retroactive sections.

“My main concern is that it helps to clarify rather than provide for continued disagreement in the condo associations,” Ige said.

SB 33 proposed extending the annual tax cap to the film industry from $35 million anyear to $50 million a year with the caveat that the University of Hawaii lease some of its land in West Oahu to the Hawaii Technology and Development Corporation.

Ige initially had hangups on the bill because of the UH provision, but changed course Tuesday, noting the expansion of Hawaii’s film industry.

Also on Ige’s veto list were measures that proposed allowing the interisland transportation of medical cannabis and regulations on the sale of location data to third-parties.

He also vetoed SB 1353, which proposed an industrial hemp program. He said the state Department of Agriculture plans to wait until federal guidelines on hemp. production are completed in the fall before beginning work on a hemp program.

Since June, Ige has signed a number of measures into law including proposals to fund the construction of a new stadium, conduct elections by mail and impose taxes on resort fees.